The Italian Scenario for Luxury Watches,2017!

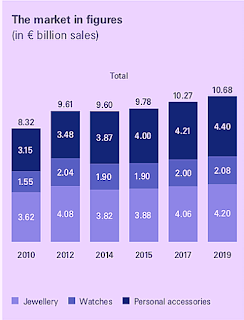

After Becoming the Prime European Market for Swiss Watches, The Italian Watch Market found Hardship in 2016. However Italians’ Enthusiasm for Watches has been Known and Recognized for Decades. Europa Star’s Serge Maillard speaks with Sylvain Rousmant, Partner at Mazars Italy, A Specialized Auditor, on the topic. In 2015 The Italian Watch Market became the Key European Market for Swiss Watches. 2016 was more difficult and The United Kingdom took the first rank again (In the aftermath of Brexit and attractive Currency Conditions), but Italians’ Enthusiasm for Watches has been Known and Recognised for Decades. We speak with Sylvain Rousmant of Mazars Italy, The International and Consulting Group, to understand more.* Italy is Europe’s Second Strongest Market for the Swiss Watch Industry, behind the United Kingdom, but ahead of Germany and France, Despite the fact that the Country has a smaller population. How can you explain this strength? The Trend of Luxury and Style is the determi