PM Modi’s Israel visit may sparkle Surat Diamonds!

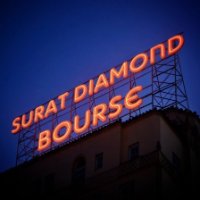

Prime Minister Narendra Modi’s assurance to Surat’s diamond traders that he was going to Israel to represent their interests could prove to be a shot in the arm for the city’s industry. Additional certainly, this could be erect bulletin for the Surat Diamond Bourse (SDB), a two-year-old trading platform looking to take the shine away from Bharat Diamond Bourse, India’s largest bourse functioning out of the Bandra-Kurla complex in Mumbai.

Company documents revised by Business Standard displays the SDB has attracted inspiring interest in its challenge to the Mumbai-based bourse even though it is still reportedly a year away from being fully functional. 3,382 applications from diamond traders to book office spaces had been accepted by SDB. In the procedure, the bourse has together almost Rs 182 crore for leasing out office spaces for which land is being allocated by the Gujarat government. A letter requesting for the allotment of land was submitted by the directors of SDB to the Gujarat government in March 2016 and the money collected will be transferred once the land heading actions are transported in the bourse’s name near Surat. SDB, which was incorporated in 2014, has also rejected 39 applications and also kept others pending for “providing insufficient information.”

SDB’s effort in preventing away the business from the BDB is stiff but not an unbearable task. The controversy-ridden BDB has been fraught with infighting with many small and medium traders finding it enviable to pay exorbitant rent for office space at the Bandra-Kurla complex. Reports counsel had been handover to Surat and later the BDB boosted to the high price Bandra-Kurla intricate from Opera House in Mumbai in 2010.

“Mumbai is a different ball game altogether. Our focus will be on encouraging small and medium diamond enterprises in the new facility. We are not looking to take away Mumbai’s business. In addition to many existing traders from Mumbai shifting base to Surat, a lot of new ones have also been allotted space” said Dinesh Navadia, President of Surat Diamond Association.

Even with the diamond trader sociability, the valued economics of a new bourse coming up in Surat could spell bad news for Mumbai. While the Mumbai bourse has an office space of 2 million square feet, Surat envisages 6.5 million square feet at a fraction of the cost. Documents show that the Mumbai bourse is packed to the hilt, with 93% habitation reported in 2015-16. Some of the small and medium traders who had protested against the move from Opera House to Bandra-Kurla complex were assigned 334 cabins in the bourse’s business centre. But all these cabins measure up to barely 39,000 square feet – just 2% of the total space leased out to some of India’s biggest diamond trading companies. The average size of each cabin given to those who faced the prospect of being priced out from Bandra-Kurla complex works out to be 116 square feet – abysmal even by Mumbai’s squeezed standards.

Dipak Shastri of Pratham Diamonds represents the dilemma of a medium scale diamond dealer at the Mumbai bourse. Shastri, a member of the bourse, was recently allotted office space in Surat although he remains non-committal on shifting. “Surat is a manufacturing hub and you can always get a glowing price than Mumbai. Surat is many times cheaper in terms of rentals, cost of living and labour” said Shastri.

It’s not just planetary but also business that seems to be flooded at Mumbai’s diamond bourse.

Between 2013-14 and 2015-16, the number of rough diamond and gem parcels imported fell by 8% while the value of imports fell 11%. The value of distributes of finished diamonds and gems for now remained everywhere the same mark of Rs 1,46,792 crore (In 2015-16, the value of exports was Rs 1,46,772 crore.) However, to the bourse’s credit, the value of its exports has grown by 25% while the value of its imports has declined 9% between 2011-12 and 2015-16: an indication that more high-value finished diamonds and gems are being traded despite emerging from a global slump in the diamond industry. The bourse ascribes the recent decline to exchange rate fluctuations in its financial statements. It states, “The rupee value to the U.S. Dollar in 2014-2015 has been between Rs 59.10 and Rs 63.85 while during 2015-2016 it varied between Rs 62.00 and Rs 68.95.”

The Precious Cargo Customs Clearance Centre (PCCCC) at the Mumbai bourse exported 70% of all finished diamonds to two nations – Hong Kong and the US. In the meantime, more than 80% of the rough diamonds that landed and compound from Belgium and UAE. Despite the head start the Mumbai bourse has over Surat in terms of infrastructure, logistics and administrative support, there is great business that still doesn’t flow through Mumbai. Surat has the largest diamond processing industry in India, with most of the country’s constructors based in this city. But 97% of all diamonds in terms of value from India were exported through the PCCCC at the Mumbai bourse. 37% of all rough diamonds smuggled by India was concluded PCCCC. Clearly, there is a lot of business to be diverted from Mumbai.

A Diamond Trading Centre (DTC) opened at the bourse in 2015 after it was declared a Special Notified Zone (SNZ) by the central government has also started attracting global mining hulks for viewing and auctioning diamonds in so-called ‘safe chambers’. More than 50% of the imports were accounted for by De Beers Auction Sales. The bourse claims to have 10 fully equipped viewing cabins, a sales cabin, a goods control room and a strong room with two safe vaults. Additional vast miners who have came occupation include De Beers, Dominion Diamond Marketing NV and ARCOS East DMCC.

For more information, Please Visit:-

www.iDiamondcloud.com

Comments

Post a Comment